Your credit score is an important factor in your financial life, as it affects your ability to obtain credit, secure a loan, and even rent an apartment. Improving your credit score can seem daunting, but with the right tips and strategies, you can take steps to boost your score and achieve financial success.

Robert Zuckerman, a finance expert, has extensive experience helping clients improve their credit scores. In this article, he shares his top tips and strategies for improving your credit score, including how to check your credit report, how to dispute errors, and how to use credit responsibly.

US Credit Score Statistics

Here are some recent credit score statistics for the United States, according to Experian’s 2021 Consumer Credit Review:

- The average FICO credit score in the United States is 711.

- The average VantageScore credit score in the United States is 688.

- The states with the highest average credit scores are Minnesota (739), North Dakota (735), and South Dakota (731).

- The states with the lowest average credit scores are Mississippi (655), Louisiana (657), and Georgia (658).

- The average number of credit cards per consumer is 4.1.

- The average credit card debt per consumer is $5,315.

- 42% of Americans have credit card debt.

- 21% of Americans have a “deep subprime” credit score (below 580).

- 47% of Americans have a prime credit score (between 660 and 799).

- 20% of Americans have a superprime credit score (above 800).

It’s important to note that these statistics are based on data from a single credit bureau and may not reflect the credit scores of all Americans. Credit scores can vary depending on the credit bureau, the scoring model used, and individual financial behaviors.

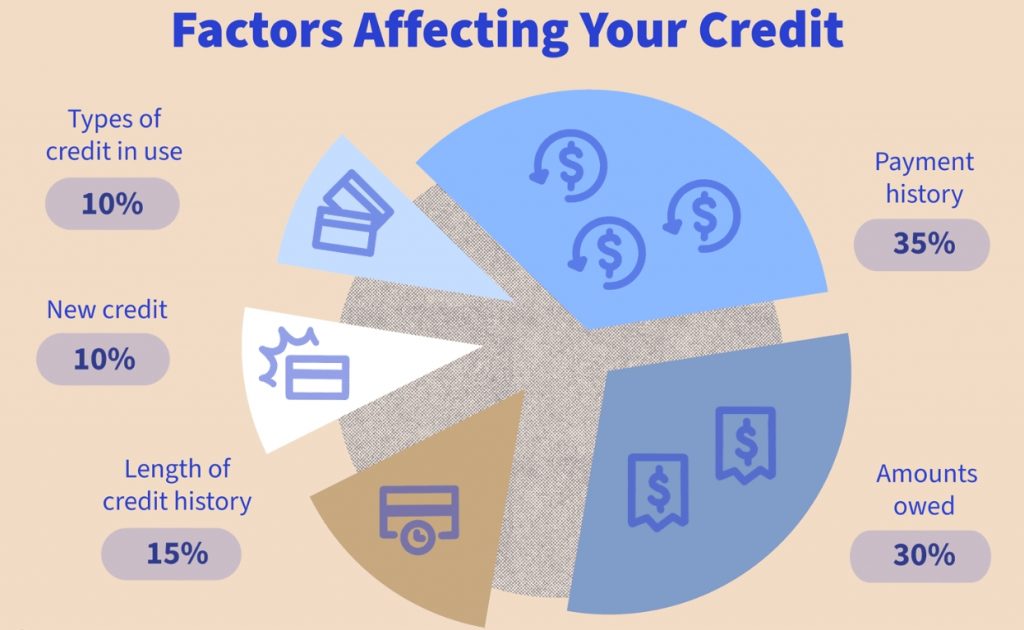

Which Factors Affect Your Credit

1. Check Your Credit Report Regularly

The first step to improving your credit score is to check your credit report regularly. Your credit report is a record of your credit history and contains information on your credit accounts, payment history, and outstanding balances. By checking your credit report, you can ensure that the information is accurate and up-to-date.

Zuckerman recommends checking your credit report at least once a year, and more frequently if you suspect errors or fraudulent activity. You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) by visiting AnnualCreditReport.com.

2. Dispute Errors on Your Credit Report

If you find errors on your credit report, such as accounts that don’t belong to you or incorrect information about your payment history, you can dispute them with the credit bureau. Zuckerman suggests contacting the credit bureau in writing to explain the error and provide any documentation to support your claim. The credit bureau must investigate your dispute and correct any errors within 30 days.

3. Use Credit Responsibly

Using credit responsibly is a key factor in improving your credit score. Zuckerman advises keeping your credit utilization low, which means not using more than 30% of your available credit. For example, if you have a credit limit of $10,000, you should aim to keep your balance below $3,000.

In addition, Zuckerman recommends making all your payments on time, as late payments can have a negative impact on your credit score. Setting up automatic payments or reminders can help ensure that you don’t miss a payment.

4. Build a Positive Credit History

Building a positive credit history can also improve your credit score. Zuckerman suggests opening a secured credit card or a credit builder loan, which can help you establish credit if you don’t have a credit history or have a poor credit history. By making payments on time and keeping your credit utilization low, you can gradually build a positive credit history.

5. Don’t Close Old Credit Accounts

Closing old credit accounts can actually have a negative impact on your credit score, as it can reduce your available credit and shorten your credit history. Zuckerman advises keeping old credit accounts open, even if you don’t use them regularly, to maintain a longer credit history.

What is the fastest way to boost your credit score?

The fastest way to boost your credit score is to make all of your payments on time and keep your credit utilization low by not using more than 30% of your available credit. Disputing errors on your credit report and building a positive credit history can also help improve your score. However, it’s important to note that improving your credit score is a gradual process and may take time.

How can I get 700 credit score in a month?

Improving your credit score to 700 in just one month is a challenging goal, as credit scores typically change slowly over time based on credit behavior and payment history. However, there are some steps you can take to potentially boost your credit score in the short term:

- Pay down your credit card balances: Reducing your credit card balances can help lower your credit utilization rate, which is the amount of credit you’re using compared to your credit limit. Keeping your credit utilization below 30% is generally recommended for improving your credit score.

- Make on-time payments: Late payments can have a negative impact on your credit score, so it’s important to make all of your payments on time. Set up automatic payments or reminders to help ensure you don’t miss a payment.

- Check for errors on your credit report: Errors on your credit report can drag down your credit score, so it’s important to review your report for any mistakes. If you find any errors, dispute them with the credit bureau to have them corrected.

- Become an authorized user: If someone you trust has a credit card with a long history of on-time payments and low balances, becoming an authorized user on that account could help improve your credit score.

- Apply for a secured credit card: If you don’t have much credit history or have a poor credit score, applying for a secured credit card and using it responsibly could help boost your score over time.

It’s important to remember that improving your credit score is a gradual process and may take longer than a month to achieve a significant increase. While these tips can help improve your score in the short term, it’s important to focus on making consistent, responsible financial decisions to maintain a good credit score over the long term.

How Credit Score Has Changed in the US Recentls

According to Experian’s 2021 Consumer Credit Review, the average FICO credit score in the United States increased from 703 in 2020 to 711 in 2021. The average VantageScore credit score also increased from 680 in 2020 to 688 in 2021. The report noted that the increase in credit scores was largely due to lower credit card balances and on-time payments during the COVID-19 pandemic. The average number of credit cards per consumer remained at 4.1 in 2021, while the average credit card debt per consumer decreased from $5,315 in 2020 to $5,223 in 2021. However, the report also found that credit card delinquencies increased during the pandemic, with 90-day delinquencies rising from 0.56% in Q1 2020 to 1.08% in Q1 2021.

Conclusion

Improving your credit score takes time and effort, but by following these tips and strategies, you can take steps to boost your score and achieve your financial goals. By checking your credit report regularly, disputing errors, using credit responsibly, building a positive credit history, and keeping old credit accounts open, you can improve your credit score and secure a brighter financial future.